-

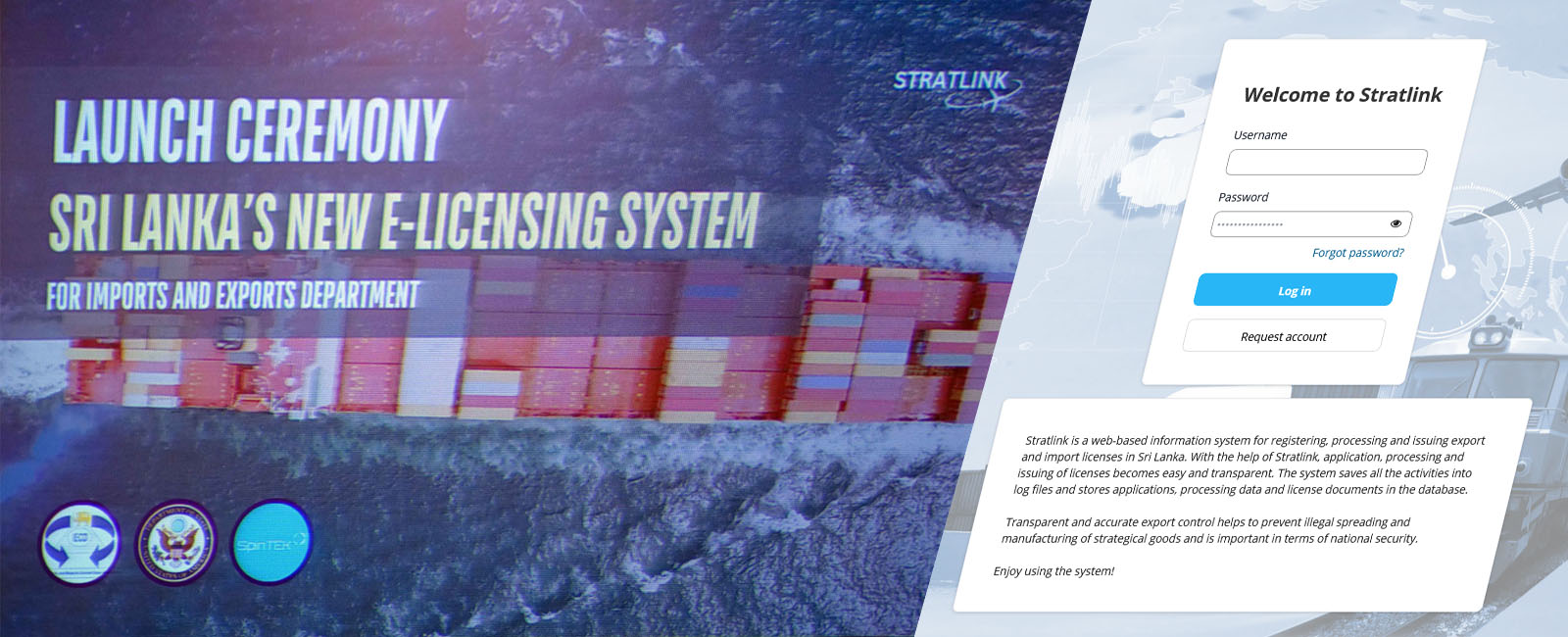

Launch Ceremony Sri Lanka's New e-Licensing System

Launch Ceremony Sri Lanka's New e-Licensing System -

Launch Ceremony Sri Lanka's New e-Licensing System

Launch Ceremony Sri Lanka's New e-Licensing System -

Launch Ceremony Sri Lanka's New e-Licensing System

Launch Ceremony Sri Lanka's New e-Licensing System -

Launch Ceremony Sri Lanka's New e-Licensing SystemLaunch Ceremony Sri Lanka's New e-Licensing SystemLaunch Ceremony Sri Lanka's New e-Licensing System

Launch Ceremony Sri Lanka's New e-Licensing SystemLaunch Ceremony Sri Lanka's New e-Licensing SystemLaunch Ceremony Sri Lanka's New e-Licensing System -

Launch Ceremony Sri Lanka's New e-Licensing System

Launch Ceremony Sri Lanka's New e-Licensing System -

-

-

-

-

-

-

-

Recommendation Authorities

National Medicine Regulatory Authority

National Medicine Regulatory Authority Department of Animal Production & Health

Department of Animal Production & Health Ayurvedic

Ayurvedic

Department Homeopathy

Homeopathy

Council Ministry of Social Empowerment & Welfare

Ministry of Social Empowerment & Welfare Civil Aviation

Civil Aviation

Authority Ministry of Industry & Commerce

Ministry of Industry & Commerce Ministry of

Ministry of

Defence Sri Lanka State Trading (General) Corporation

Sri Lanka State Trading (General) Corporation Precursor Control

Precursor Control

Authority Department of Fisheries & Aquatic Authority

Department of Fisheries & Aquatic Authority Ministry of Petroleum & Petroleum Resources Development

Ministry of Petroleum & Petroleum Resources Development Registrar of

Registrar of

Pesticides National Fertilizer

National Fertilizer

Secretariat Agriculture

Agriculture

Department Sri Lanka

Sri Lanka

Standards Institute Sri Lanka

Sri Lanka

Excise Department Telecommunication Regulatory Commission

Telecommunication Regulatory Commission National

National

Ozone Unit Central Environment Authority

Central Environment Authority Sri Lanka Atomic Energy Regulatory Council

Sri Lanka Atomic Energy Regulatory Council Sri Lanka

Sri Lanka

Tea Board Forest

Forest

Department Sri Lanka

Sri Lanka

Central Bank Marine Environment Protection Authority

Marine Environment Protection Authority Sri Lanka

Sri Lanka

Customs Sri Lanka

Sri Lanka

Port Authority

Policies

Policies

Required Documentation

- Prior to arrival of goods

- Letter of Request of the Applicant

- Proforma Invoice

- Letter of the Supplier to confirm sending of goods free of charge

- Copy of the relevant agreement, in the case of goods being imported for a project

Charges - Rs. 500.00

- After arrival of goods

- Letter of Request of the Applicant

Commercial Invoice, Bill of Lading / Airway Bill, Customs Declaration, Delivery Order, Packing list

Letter of the Supplier to confirm sending of goods free of charge

Certificate of Registration of Business

Copy of the relevant agreement, in the case of goods being imported for a project

- Letter of Request of the Applicant

Charges - Rs. 1000.00

- Procedure

- Submit the above documents to the Policy Division

- Make payments to the Shroff using the Paying-in-Voucher for approved documents

- Submit the receipt issued for the payment to the Policy Division

- Obtain signed and seal-affixed documents from the relevant Division

Required Documentation

- Letter of Request of the Applicant

- Letter issued by the Bank or Letter of the Applicant endorsed by the Bank

- Commercial Invoice

- Bill of Lading / Airway Bill (B.L / A.W.B.)

- Assessment Notice

- Copy of Customs Declaration

Procedure

- Submit the above documents to the Policy Division

- Make payments to the Shroff using the Paying-in-Voucher for approved documents

- Submit the receipt issued for the payment to the Policy Division

- Obtain signed and seal-affixed documents from the relevant Division

Charges

Rs.1000.00

Required Documentation

- Letter of Request by the Import Organization

- Certificate of Registration of Business

- Certification of Incorporation of the Import Organization

- Report of the Directorate (Form 20)

- Audit Reports of last two years

- Bank Accounts Reports of last three months

- Reports on Income Tax Payments

- Reports on Value Added Tax Payments

- Agreement with the Supplier

- Pro forma Invoice

Procedure

- Submit the above documents to the Policy Division

- Make payments to the Shroff using the Paying-in-Voucher for approved documents

- Submit the receipt issued for the payment to the Policy Division

- Obtain signed and seal-affixed documents from the relevant Division

Charges

Rs. 1000.00

Required Documentation

- Letter of Request of the Applicant along with Customs Query

- Import Documents Set (Commercial Invoice, Bill of Lading, Customs Declaration)

- Clarification by the Local Bank on the current state of remittance of exchange pertaining to import

Procedure

- Submit the above documents to the Policy Division

- Make payments to the Shroff using the Paying-in-Voucher for approved documents

- Submit the receipt issued for the payment to the Policy Division

- Obtain signed and seal-affixed documents from the relevant Division

Charges

Rs. 1000.00

Reach Us

No: 75 1/3, 1st Floor, Hemas Building,

York Street,

P.O. Box - 559,

Colombo 01,

Sri Lanka.

(94) 112 326 774

(94) 112 322 046

(94) 112 322 053

(94) 112 322 007

(94) 112 328 486

deptimpt[at]sltnet.lk

Right to Information (RTI)

Right to Information (RTI)